No products in the cart.

Bookkeeping

Does the Balance Sheet Always Balance?

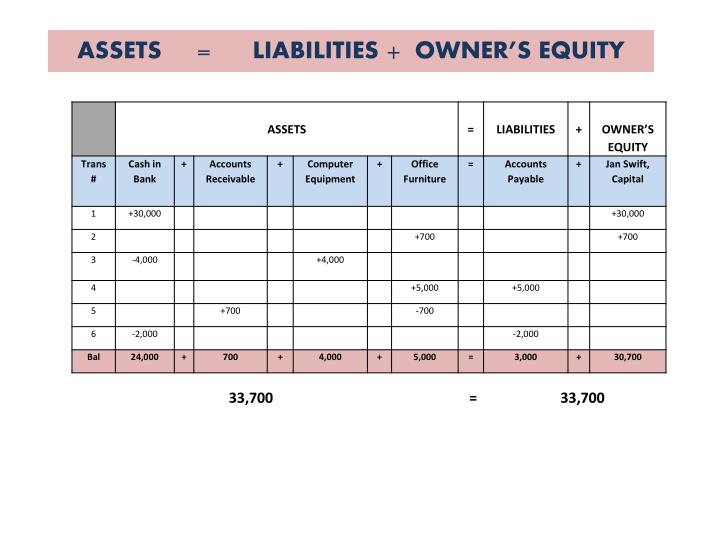

If a company’s stock is publicly traded, earnings per share must appear on the face of the income statement. The owner’s equity is the balancing amount in the accounting equation. So whatever the worth of assets and liabilities of a business are, the owners’ equity will always be the remaining amount (total assets MINUS total liabilities) that keeps the accounting equation in balance. The purpose of this article is to consider the fundamentals of the accounting equation and to demonstrate how it works when applied to various transactions.

What is the Balance Sheet?

Please see Robinhood Derivative’s Fee Schedule to learn more about commissions on futures transactions. Once you get the loan, this is how your accounting equation changes. The business has paid $250 cash (asset) to repay some of the loan (liability) resulting in both the cash and loan liability reducing by $250. $10,000 of cash (asset) will be received from the bank but the business must also record an equal amount representing the fact that the loan (liability) will eventually need to be repaid. The cash (asset) of the business will increase by $5,000 as will the amount representing the investment from Anushka as the owner of the business (capital).

Assets = Liabilities + Equity

The total shareholder’s equity section reports common stock value, retained earnings, and accumulated other comprehensive income. Apple’s total liabilities increased, total equity decreased, and the combination of the two reconcile to the company’s total assets. The balance sheet is also known as the statement of financial position and it reflects the accounting equation. The balance sheet reports a company’s assets, liabilities, and owner’s (or stockholders’) equity at a specific point in time.

- It is based on the idea that each transaction has an equal effect.

- The balance sheet reports a company’s assets, liabilities, and owner’s (or stockholders’) equity at a specific point in time.

- Accounts Payables, or AP, is the amount a company owes suppliers for items or services purchased on credit.

- For the past 52 years, Harold Averkamp (CPA, MBA) hasworked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online.

- Alternatively, suppose the company decided to borrow $100 to buy the chair as opposed to using its own cash.

How Balance Sheets Work

Investors and analysts have to analyze the financial statements to derive insights into the business performance. The expanded accounting equation shows the relationship between your balance sheet and income statement. Revenue and owner contributions are the two primary sources that create equity. Equity refers to the owner’s value in an asset or group of assets. Equity is also referred to as net worth or capital and shareholders equity.

Additional paid-in capital or capital surplus represents the amount shareholders have invested in excess of the common or preferred stock accounts, which are based on par value rather than market price. Shareholder equity is not directly related to a company’s market capitalization. The latter is based on the current price of a stock, while paid-in capital is the sum of the equity that has been purchased at any price. Each category consists of several smaller accounts that break down the specifics of a company’s finances. These accounts vary widely by industry, and the same terms can have different implications depending on the nature of the business. Companies might choose to use a form of balance sheet known as the common size, which shows percentages along with the numerical values.

Business Insights

Ltd has below balance sheet for 5 years, i.e., from the year 2014 to 2018. Suppose a proprietor company has a liability of $1500, and owner equity is $2000. Calculation of Balance sheet, i.e., Total asset of a company will sum of liability and equity. If you want to calculate the change in the value of anything from its previous values—such as equity, revenue, or even a stock price over a given period of time—the Net Change Formula makes it simple.

Capital essentially represents how much the owners have invested into the business along with any accumulated retained profits or losses. The capital would ultimately belong to you as the business owner. It’s important to note that how a balance sheet is formatted differs depending on where an organization is based. The example above the role of decision modeling in business decision management complies with International Financial Reporting Standards (IFRS), which companies outside the United States follow. In this balance sheet, accounts are listed from least liquid to most liquid (or how quickly they can be converted into cash). The balance sheet equation answers important financial questions for your business.

This balance sheet compares the financial position of the company as of September 2020 to the financial position of the company from the year prior. Different accounting systems and ways of dealing with depreciation and inventories will also change the figures posted to a balance sheet. Because of this, managers have some ability to game the numbers to look more favorable.

Below liabilities on the balance sheet, you’ll find equity, the amount owed to the owners of the company. These are listed on the bottom, because the owners are paid back second, only after all liabilities have been paid. The accounting method under which revenues are recognized on the income statement when they are earned (rather than when the cash is received). If a business buys raw materials and pays in cash, it will result in an increase in the company’s inventory (an asset) while reducing cash capital (another asset). Because there are two or more accounts affected by every transaction carried out by a company, the accounting system is referred to as double-entry accounting.

The fundamental accounting equation, also called the balance sheet equation, is the foundation for the double-entry bookkeeping system and the cornerstone of accounting science. In the accounting equation, every transaction will have a debit and credit entry, and the total debits (left side) will equal the total credits (right side). In other words, the accounting equation will always be “in balance”.

Our easy online enrollment form is free, and no special documentation is required. No, all of our programs are 100 percent online, and available to participants regardless of their location. Debits and Credits are the words used to reflect this double-sided nature of financial transactions.