No products in the cart.

Bookkeeping

What Is the Accounting Equation? Examples & Balance Sheet

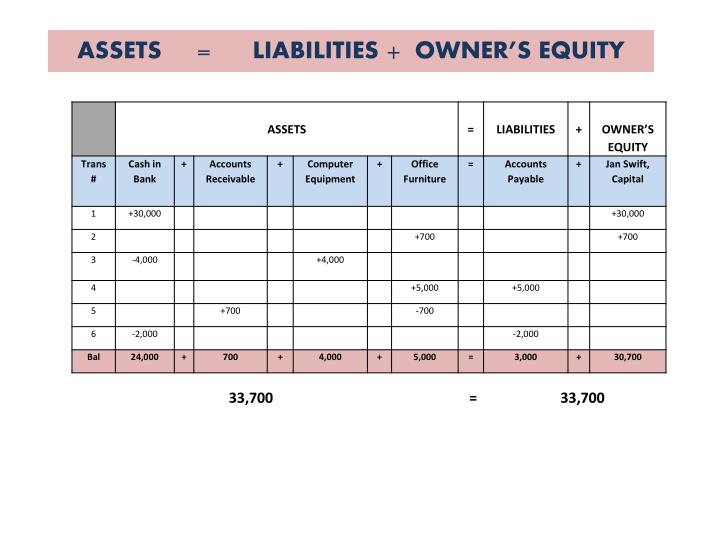

Your bank account, company vehicles, office equipment, and owned property are all examples of assets. We know that every business holds some properties known as assets. The claims to the assets owned by a business entity are primarily divided into two types – the claims of creditors and the claims of owner of the business. In accounting, the claims of creditors are referred to as liabilities and the claims of owner are referred to as owner’s equity. The major reason that a balance sheet balances is the accounting principle of double entry. This accounting system records all transactions in at least two different accounts, and therefore also acts as a check to make sure the entries are consistent.

More Accounting Equation Resources

These are listed at the bottom of the balance sheet because the owners are paid back after all liabilities have been paid. Since the balance sheet is founded on the principles of the accounting equation, this equation can also be said to be responsible for estimating the net worth of an entire company. The fundamental components of the accounting equation include the calculation of both company holdings and company debts; thus, it allows owners to gauge the total value of a firm’s assets. The accounting equation plays a significant role as the foundation of the double-entry bookkeeping system. The primary aim of the double-entry system is to keep track of debits and credits and ensure that the sum of these always matches up to the company assets, a calculation carried out by the accounting equation. It is based on the idea that each transaction has an equal effect.

Analyst Certification FMVA® Program

- It can’t account for inflation or depression, nor the change in the value of assets.

- Some candidates may qualify for scholarships or financial aid, which will be credited against the Program Fee once eligibility is determined.

- Owner’s or stockholders’ equity also reports the amounts invested into the company by the owners plus the cumulative net income of the company that has not been withdrawn or distributed to the owners.

- As the company pays off its AP, it decreases along with an equal amount decrease to the cash account.

Knowing what goes into preparing these documents can also be insightful. For all recorded transactions, if the total debits and credits for a transaction are equal, then the result is that the company’s assets are equal to the sum of its liabilities and equity. The accounting equation states that a company’s assets must be equal to the sum of its liabilities and equity on the balance sheet, at all times.

Accounting Equation

Accounts receivable list the amounts of money owed to the company by its customers for the sale of its products. Assets include cash and cash equivalents or liquid assets, which may include Treasury bills and certificates of deposit (CDs). Property, Plant, and Equipment (also known as PP&E) capture the company’s tangible fixed assets. Some companies will class out their PP&E by the different types of assets, such as Land, Building, and various types of Equipment. He funds the venture with $10,000 of his own money and takes out a small business loan for $30,000.

For the balance sheet to balance, total assets should equal the total of liabilities and shareholders’ equity. Examples of assets include cash, accounts receivable, inventory, prepaid insurance, investments, land, buildings, equipment, and goodwill. From the accounting equation, we see that the amount of assets must equal the combined amount of liabilities plus owner’s (or stockholders’) equity. The accounting equation (also called the basic accounting equation, or the balance sheet equation) represents the relationship between assets, liabilities, and owners’ (or shareholders’) equity. It describes what a company owns (assets) and what a company owes (liabilities and equity). Accounting equation describes that the total value of assets of a business entity is always equal to its liabilities plus owner’s equity.

Includes non-AP obligations that are due within one year’s time or within one operating cycle for the company (whichever is longest). Notes payable may also have a long-term version, which includes notes with a maturity of more than one year. $30,000 is credited to cash, and $30,000 is debited to inventory. Total Assets must equal total Liabilities plus total Equity.

The company uses this account when it reports sales of goods, generally under cost of goods sold in the income statement. Enter your name and email in the form below and download the free template now! You can use the Excel file to enter the numbers for any company and gain a deeper understanding of how balance sheets work. An investment business accounting systems is an asset bought by an individual or organization with the expectation that it will generate some future income or profit—Examples of investments may include stocks and real estate. Capex, short for capital expenditure, is an expense incurred by businesses to acquire, maintain, or improve a long-term asset, like buildings or equipment.

Without the balance sheet equation, you cannot accurately read your balance sheet or understand your financial statements. Different transactions impact owner’s equity in the expanded accounting equation. Revenue increases owner’s equity, while owner’s draws and expenses (e.g., rent payments) decrease owner’s equity.